where's my unemployment tax refund

Luckily the millions of people who are getting a payout if they filed their tax returns before the big tax break in the American Rescue Plan became law can track their refund with this IRS tool. Still they may not provide information on the status of your unemployment tax refund.

1099 G Unemployment Compensation 1099g

Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund.

. You did not get the unemployment exclusion on the 2020 tax return that you filed. This is because there is nowhere for your return to specifically go until the IRS begins accepting and processing returns for the tax season. The Internal Revenue Service doesnt have a separate portal for checking the unemployment compensation tax refunds.

Your tax on Form 1040 line 16 is not zero. Select the tax year for the refund status you want to check. By Anuradha Garg.

The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state unemployment. However if you havent yet filed your tax return you should report this reduction in unemployment income on your Form 1040. If all four of those conditions are true The IRS will recalculate your tax return and send you an additional refund.

You can use the IRS online tracker applications the Wheres My Refund and Amended Return Status tools. Instead the IRS will adjust the tax return youve already submitted. This newest cash windfall is from President Joe Bidens 19 trillion American Rescue Plan which was able to waive federal tax on up to 10200 of unemployment benefits that were collected by.

WHILE there are 436000 returns are still stuck in the IRS system Americans are looking for ways to track their unemployment tax refund. An immediate way to see if the IRS processed your refund is by viewing your tax records online. The first way to get clues about your refund is to try the IRS online tracker applications.

The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion. Most taxpayers will receive their unemployment refunds automatically via direct deposit or paper check. Monday to Friday 9 am to 4 pm except District holidays.

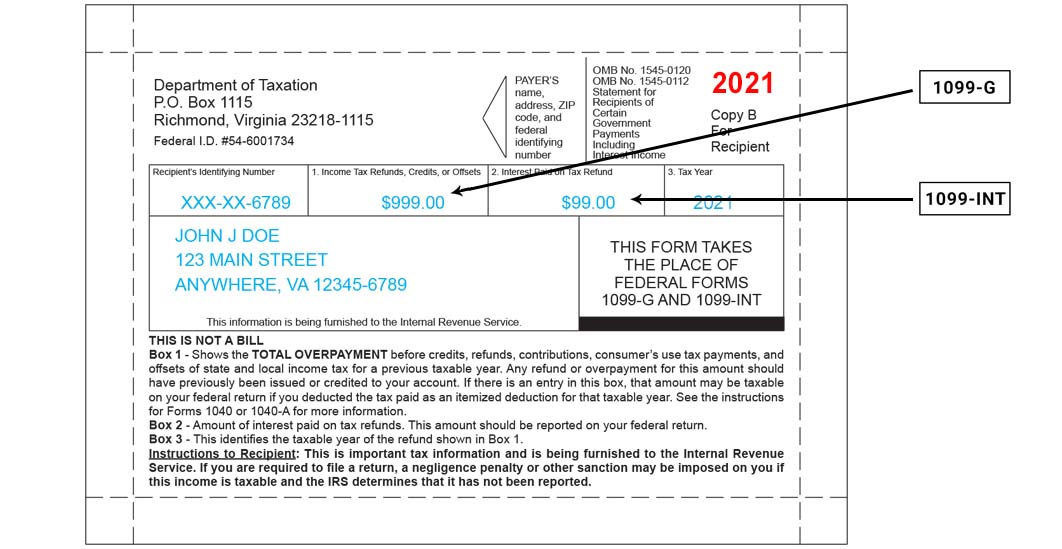

Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF. Office of Tax and Revenue. You typically dont need to file an amended return in order to get this potential refund.

You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your unemployment tax refund. Again anyone who has not paid taxes on their UI benefits in 2020. You must have your social security number and the exact amount of the refund request.

Will I receive a 10200 refund. If you filed an amended return you can check the. If you received unemployment benefits last year and filed your 2020 tax return relatively early you may find a check in your mailbox soon.

These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. To report unemployment compensation on your 2021 tax return. 1101 4th Street SW Suite 270 West Washington DC 20024.

Your Adjusted Gross Income AGI not including unemployment is. Since May the IRS has been sending tax refunds to Americans who filed their 2020 return and reported unemployment compensation before tax law changes were made by the American Rescue Plan. The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability.

An immediate way to see if the IRS processed your refund is by viewing your tax records online. Ask the Chief Financial Officer. Viewing your tax records online is a quick way to determine if the IRS processed your refund.

You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your unemployment tax refund. The IRS is still sending out refunds for the unemployment exclusion. They dont need to file an amended.

If you did NOT PAY taxes on your unemployment and received your full 60000 weekly UI payments you will not be getting the unemployment refund. Your tax on Form 1040 line 16 is not zero. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. Your social security number or ITIN Your filing. To request a copy of.

Those payment were originally refundable credits and then when the 2020 rescue act kicked in it made them nontaxable. Your Adjusted Gross Income AGI not including unemployment is less than 150000. 22 2022 Published 742 am.

The deadline to file your federal tax return was on May 17. Thats the same data. Updated March 23 2022 A1.

Enter the amount of tax withheld from Form 1099-G Box 4 on line 25b of your Form 1040 or Form 1040-SR. The unemployment exclusion would appear as a negative amount on Schedule 1 line 8 with the abbreviation UCE on the dotted line to the left of the amount. The Wheres My Refund tool can be accessed here.

Luckily the millions of people who are. Until then any and all submitted tax returns for the current season are blocked from being put into the system so the IRS can finish any maintenance repairs updates and testing. Check your unemployment refund status by entering the following information to verify your identity.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

1099 G 1099 Ints Now Available Virginia Tax

Here S How To Track Your Unemployment Tax Refund From The Irs

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

Unemployment Tax Updates To Turbotax And H R Block

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Where S My Tax Refund Why Irs Checks Are Still Delayed

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Interesting Update On The Unemployment Refund R Irs

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor