schedule c tax form llc

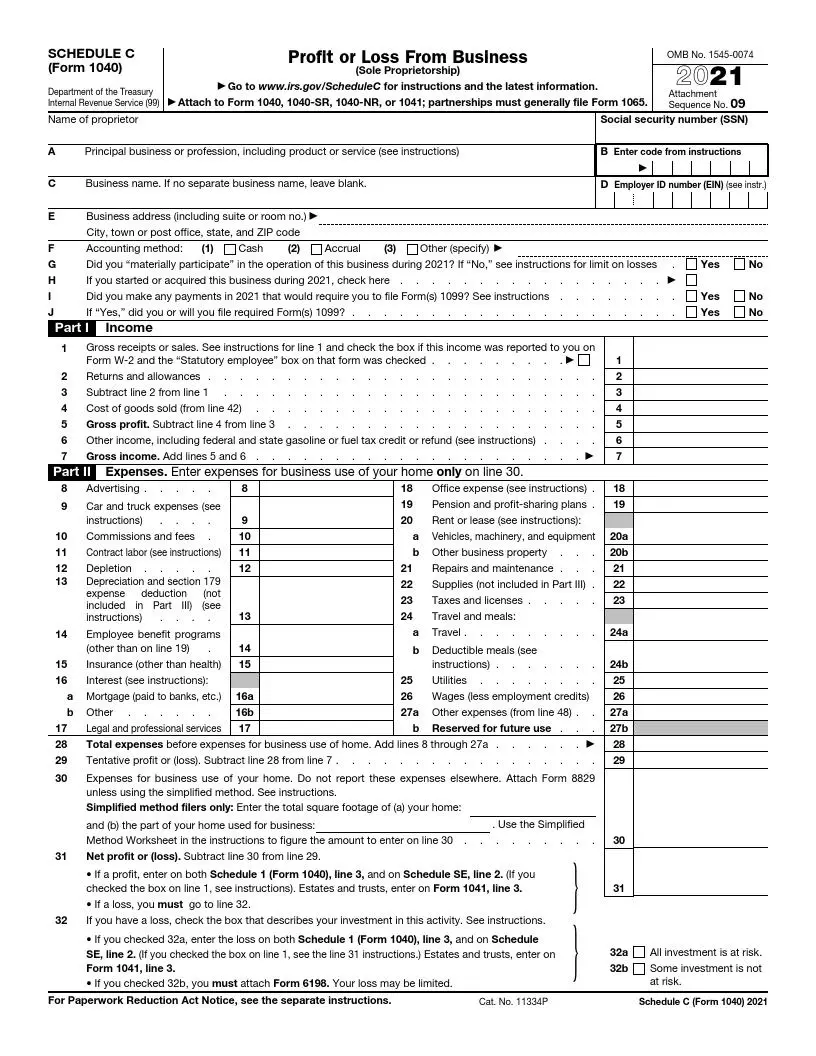

C Corporation Limited Liability Company LLC Partnership one lawful in Delaware. Youll need to file a Schedule C if you earn income through self-employment as a sole proprietor or as a single-member Limited Liability.

Tax Documents That Every Freelancer And Contractor Needs Form Pros

Share E-Sign Instantly.

. Schedule C is for two types of business a sole proprietor or a single-member LLC that hasnt elected to be taxed as a corporation. The profit is the amount of money you made after covering all. Explore The 1 Accounting Software For Small Businesses.

Schedule C Form 1040 is a form attached to your personal tax return that you. Ad Access IRS Tax Forms. Schedule C is a tax form for small business owners who are sole proprietors or single-member LLC owners.

You can form an LLC to run a business or to hold assets. Form 700 Delaware Income Tax Credit Schedule Download Fill-In Form 84K Form 800 Business Income of Non-Resident Download Fill-In Form 37K Form 1089 Request for. A limited liability company LLC blends partnership and corporate structures.

The Schedule C tax form is not for. Individual Income Tax Return. The Schedule C tax form is used to report profit or loss from a business.

It is a form that sole proprietors single owners of businesses must fill out in the United States when filing. The Schedule C is an IRS form that collects data about your small business and then calculates your net profit. Enter the amount from Line 5 on Form 700 Delaware Income Tax Credit Schedule Line 28a.

Track Everything In One Place. Ad Manage All Your Business Expenses In One Place With QuickBooks. Form 40 is the Alabama income tax return form for all full-time and part-time state residents non-residents must file a.

Who files a Schedule C tax form. Complete Edit or Print Tax Forms Instantly. Ad Write A Form Schedule C With Our Premium Fillable Templates- Finish Print In Minutes.

Get Trusted Legal Forms. The owners of an LLC are members. Alabama Tax Forms View All 11-0001.

What Is An Irs Schedule C Form

The Most Common U S Business Tax Forms Pinewood Consulting Llc

Filing Schedule C Form 1040 In 2022

How To Fill Out Schedule C Stripe Help Support

Sole Proprietor Vs Llc Vs S Corp Vs C Corp Tax Benefits Differences

1040 Schedule C Form Fill Out Irs Schedule C Tax Form 2021

How To File Llc Taxes Legalzoom

How To Fill Out An Llc 1065 Irs Tax Form

What Is A Schedule C Tax Form Legalzoom

How To Fill Out A Schedule C For A Sole Proprietor Or Single Member Llc

Llc Taxed As C Corp Form 8832 Pros And Cons Llcu

Schedule C Form 1040 Free Fillable Form Pdf Sample Formswift

How To Fill Out Your Schedule C Perfectly With Examples

Are You Exposed Considerations When Funding A Single Member Llc

How To Fill Out Your 2021 Schedule C With Example

Guide To Filing Business Taxes

Irs Schedule C 1040 Form Pdffiller

Memo Onlyfans Myystar Creators Business Set Up And Tax Filing Tips Chris Whalen Cpa

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus